Through Legal & General’s new global Asset Management division, we are helping Legal & General meet its ambitious goals for the future and build the strongest possible proposition for our clients and partners.

Legal & General shared its new Group strategy, setting out how the businesses will evolve to meet the changing needs of customers, clients and society.

We’re now part of a new, global Asset Management division, coming together with colleagues at Legal & General Investment Management (LGIM), to develop blended public and private market solutions for clients and partners globally, and address the growing demand for productive finance.

Investing society's capital, for society's benefit

Legal & General’s alternative asset platform

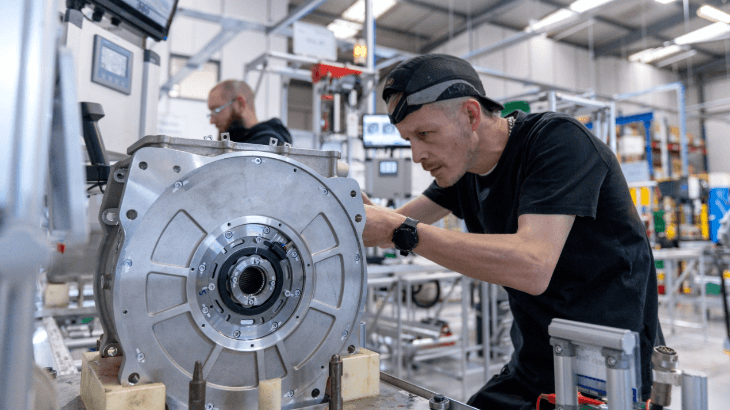

We seek opportunities to invest in sectors where there is a lack of investment and enduring demand in order to support society’s needs, namely residential property, specialist commercial real estate, clean energy, alternative credit and SME equity.

We have built market-leading capabilities in a range of alternative assets, delivering depth of resource, track record and intellectual property.

Enabling positive change

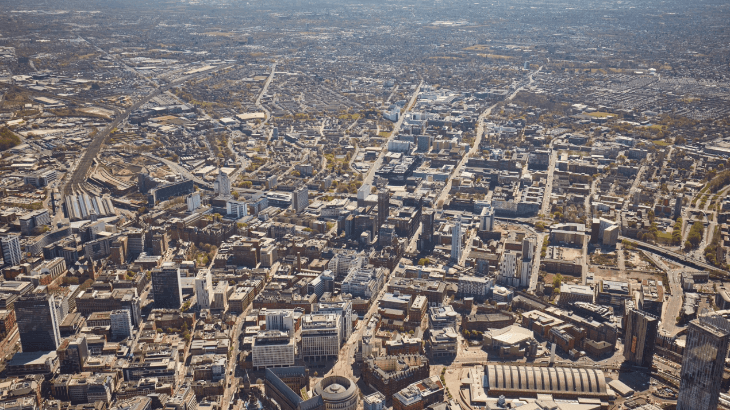

We are addressing the chronic under-supply of housing, backing new investment in infrastructure and clean energy, and investing in start-up businesses to drive innovation and growth across the UK.

Investing from the Group’s balance sheet gives us the flexibility to look beyond the size, volume and tenure requirements that limit other many institutional funds.

Sharing an ecosystem of partners

We are creating world leading partnerships to accelerate growth, invest in the real economy, transform communities, protect our planet and build a better and fairer society.